Managing Risks and Assets: Financial Update

Strengthening Our Process

For the past three years, I've had the opportunity to share semi-annual financial updates with you. Throughout these articles, I've continued to emphasize the strength, security and solid foundation that will lead GBU through the next 129 years. If you recall, I've consistently discussed that while we have a solid foundation, it would be necessary to move forward and build upon the past's significant accomplishments. Further, these changes would be up to all of us (members, agents, employees, board members) to help facilitate as everyone is impacted by how we are evolving and growing. I am excited to share what we've accomplished as the incremental changes we've made over the years have come to fruition in very noticeable ways in 2020.

The most obvious changes to GBU are the visual changes: the new look of The Reporter, the new branding and the increase in the number of Home Office employees. Additional changes that you may not yet be aware of are the new life insurance products that have just been introduced (March 1) and the new GBU Life Member Community platform. We are working on new technologies for our Underwriting/New Business and Customer Service Teams, product licensing expansion in additional states and future enhancements to our annuity products.

These changes were a collaborative effort by members, employees and agents with the oversite and approval of

GBU National Board of Directors. In the last year, a group of active district members was pooled to create the Fraternal

Advisory Council (FAC). The FAC is assisting Matt Blistan and his team to have a clearer understanding of what assistance and programs the districts and members want. In addition, GBU created a Producer Advisory Council (PAC) comprised of GBU agents. This council has been providing great input and feedback in developing the new life insurance products along with new technologies for underwriting/new business.

As GBU expands on its solid foundations, it has a plan which includes all members. One process not mentioned which I

believe is the most important, is how GBU monitors these changes to ensure financial stability and protect the funds that

you have entrusted to GBU for years to come. It is important that GBU manages its growth rate to maintain financial

stability. With the help of our actuary, a modeling program has been developed in which each product's sales forecast is input along with its historical results, thereby creating an insurance operations forecast. My finance team will use these numbers, along with the expense budget numbers, received from all areas of the society to arrive at a forecast. This forecast is reviewed and updated on a quarterly basis. The process of modeling and forecasting will help ensure any GBU expansion will occur in a manner in which the society remains financially stable in the future.

As you can see there is a well-planned process for the expansion of GBU. As with any expansion, there will be “growing pains." As we encounter some of these “growing pains," we ask for your understanding and patience.

Assets

Liabilities and Unassigned Surplus

Summary of Operations

Capital and Surplus Account

About the Numbers

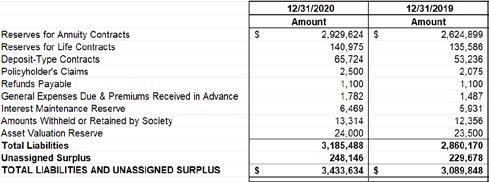

GBU’s 2020 financial results continue to be strong. GBU’s assets increased 11.13% to $3.434 billion, and we had a similar increase of 11.37% to liabilities which are now $3.185 billion. Reserves for annuity contracts make up $2.930 billion of the

liabilities while investments in bonds account for $3.249 billion of the assets. Surplus remains very strong at $248.15 million, an 8.04% increase. GBU’s current solvency ratio is 107.79%. This means for every $100.00 of liabilities there is $107.79 of assets.

The net income after refunds to members is $25.76 million which is $5.42 million lower than 2019. In our 2020 financial forecast, we planned for a $28.30 million net income which is only $2.54 million more than actual results. This is a good result considering all of the factors which made 2020 an especially unique year. Total revenues for the year were

$623.09 million, an increase of $3.09 million from 2019. GBU continues to have an exceptional cash flow from operations. For 2020, cash flow from operations was $353.7 million. This is an increase of $11.8 million from the 2019 amount of $341.9 million.

As we move forward in 2021 and beyond, GBU will continue to expand and build on the solid foundation that I previously mentioned. This will mean additional changes for the improvement and strengthening of the society. GBU will continue to put members first while securing futures.